New APRA Rules Effective 1 February 2026

New APRA Rules Effective 1 February 2026 -

Limit High Debt-to-Income Home Loans to Contain Riskier Lending.

✅ 1. Debt-to-Income (DTI) Limits Activated

From 1 February 2026, the Australian Prudential Regulation Authority (APRA) will introduce a formal cap on high debt-to-income lending — the first time such a macroprudential tool has been activated in Australia.

What’s changing

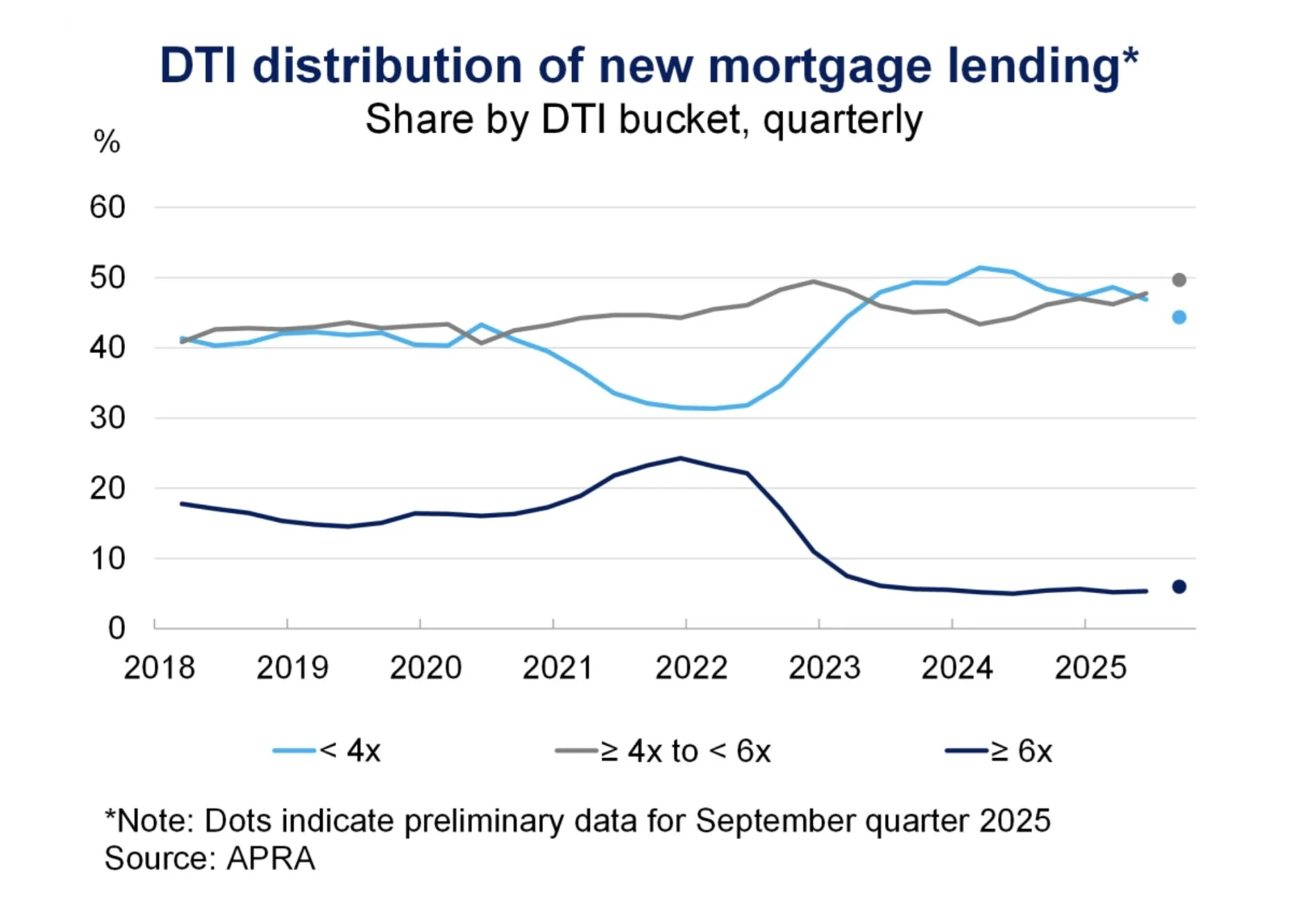

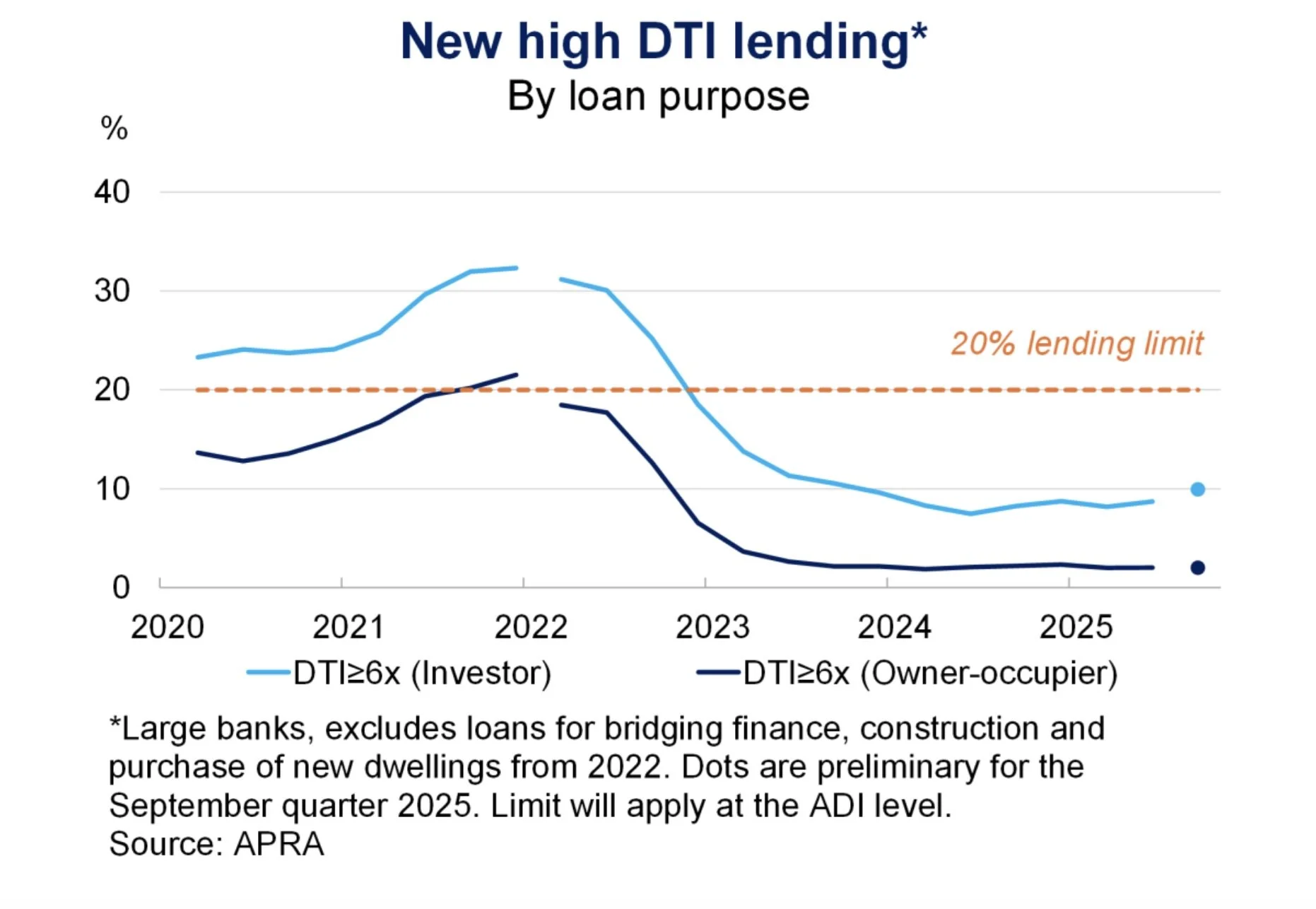

Lenders (Authorised Deposit-taking Institutions or ADIs like banks) can issue no more than 20 % of new mortgage lending where the borrower’s debt exceeds six times their gross annual income (i.e., a DTI ≥ 6).

This cap applies separately to:

• Owner-occupier loans

• Investment loans

— meaning each pool is measured independently.

Why six times earnings?

A debt-to-income of 6× is widely viewed by regulators as the threshold beyond which household leverage becomes riskier and more sensitive to interest rate changes or income shocks.

📍 2. Who the Limits Affect

Although the rule applies to all new loans from 1 Feb:

✔ Most owner-occupiers won’t notice much change initially

Most ordinary home buyers already borrow well under a DTI of 6, and current lending activity is still below the 20 % cap for high-DTI loans.

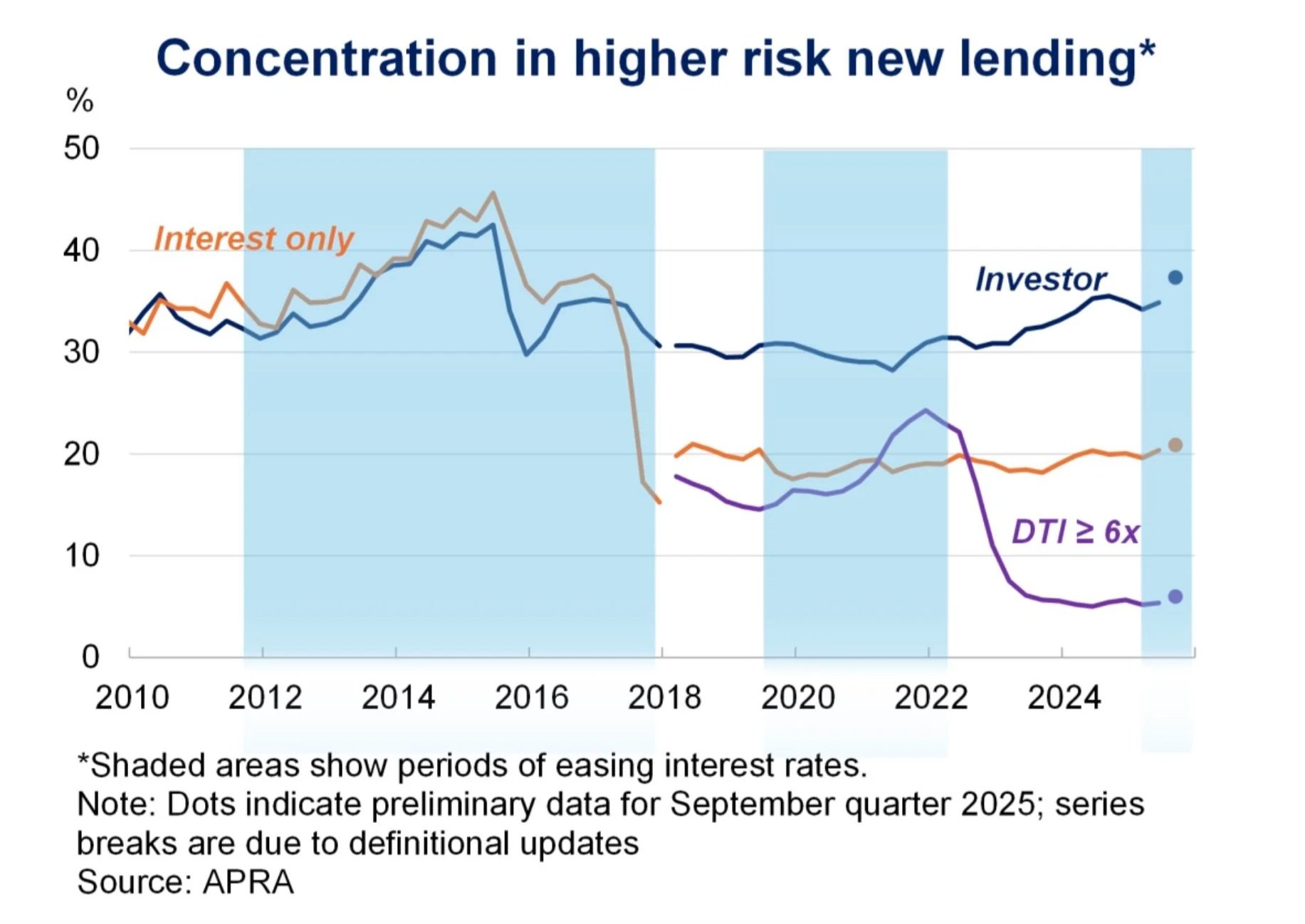

⚠ Investors and high-geared borrowers are more likely to be affected

Investors often borrow larger amounts relative to income, meaning some may fall into the high-DTI category and could see reduced borrowing capacity if a lender is near its 20 % limit.

Banks may tighten criteria or prioritise borrowers with stronger incomes if they approach their DTI allocation limit.

Loans not counted toward the cap

Bridging loans (when moving house)

Loans for newly built or under-construction homes

These exemptions are intended to avoid constraining housing supply or home transitions.

📊 3. Why APRA Is Introducing the Changes

APRA says the rules are a macroprudential safeguard — designed to protect both the financial system and households by preventing too much high-risk lending before it becomes a systemic problem.

Key drivers

Rising household debt and sustained credit growth

Concern about high DTI lending increasing too quickly in a low-rate environment

The potential for high leverage to amplify financial stress if rates rise or income conditions soften

APRA’s Chair has stated that rather than tightening serviceability buffers after problems emerge, pre-emptive limits help keep financial risks contained.

📌 4. What Borrowers Should Know Going Into 2026

🔍 A. Borrowing capacity may feel tighter for high DTI applications

If your planned loan pushes your debt above six times your income, your lender might be more conservative or you could face a delayed approval if a bank has reached the 20 % limit in that quarter.

💡 B. Most buyers won’t see immediate change

Because high DTI loans form a relatively small share of current lending, the new cap isn’t expected to hit most borrowers straight away — it’s designed as a guardrail, not a handbrake.

📈 C. Investors and refinance applicants need careful planning

Investors and highly geared borrowers (e.g., expanding portfolios) should be especially mindful of DTI trends and consider how loan structuring, income combinations or alternative lenders may influence outcomes.

🛠 D. Existing loans are unaffected

Only new loans written from 1 Feb 2026 are subject to the rule — existing mortgages won’t be re-tested automatically.

📝 Bottom Line

APRA’s new rules from 1 February 2026 introduce the first formal debt-to-income cap for Australian lenders, limiting high-leverage lending to protect financial stability. While most typical borrowers won’t feel a change straight away, investors and high-geared borrowers should start planning early to understand how their borrowing scenarios could shift under the new environment.

To explore your options, you can book a complimentary discovery call with Principal Mortgage Broker Shona Stephenson.

Shona will walk you through the lending process, assess your borrowing capacity, and help you understand the application pathway and loan structures available to you — recommending the strategy that best fits your situation, goals and risk profile.

You’ll receive clear, practical guidance and the level of care and attention our clients consistently praise.

Best Foot Forward Mortgage Solutions

📞 0417 693 281

✉️ shona@bestff.com.au

🌐 https://www.bestff.com.au/

The information contained is general information only and does not consider your objectives, financial situation and needs. Please talk to us if you need a fast-tracked home loan, and we can help you find a lender that has the processes in place to process the application quickly. We strongly recommend that you do not act on any information provided on this website without individual advice from your trusted advisor. You should also obtain a copy of and consider the Product Disclosure Statement for all financial products before making any decision.

Best Foot Forward always tries to make sure all information is accurate. However, when reading our website, please always consider our Disclaimer policy.