How the Australian Home Guarantee Has Affected the Sydney, Brisbane and Melbourne Property Markets (2026 Update)

The Australian Government’s Home Guarantee Scheme — most recently expanded into a broader 5% Deposit Scheme — has become one of the most significant policy tools shaping property market dynamics in 2025–26. Designed to help first home buyers enter the market sooner with a smaller deposit and without lenders mortgage insurance (LMI), the scheme has had measurable effects in Australia’s largest markets: Sydney, Melbourne and Brisbane.

What the Housing Guarantee Actually Does

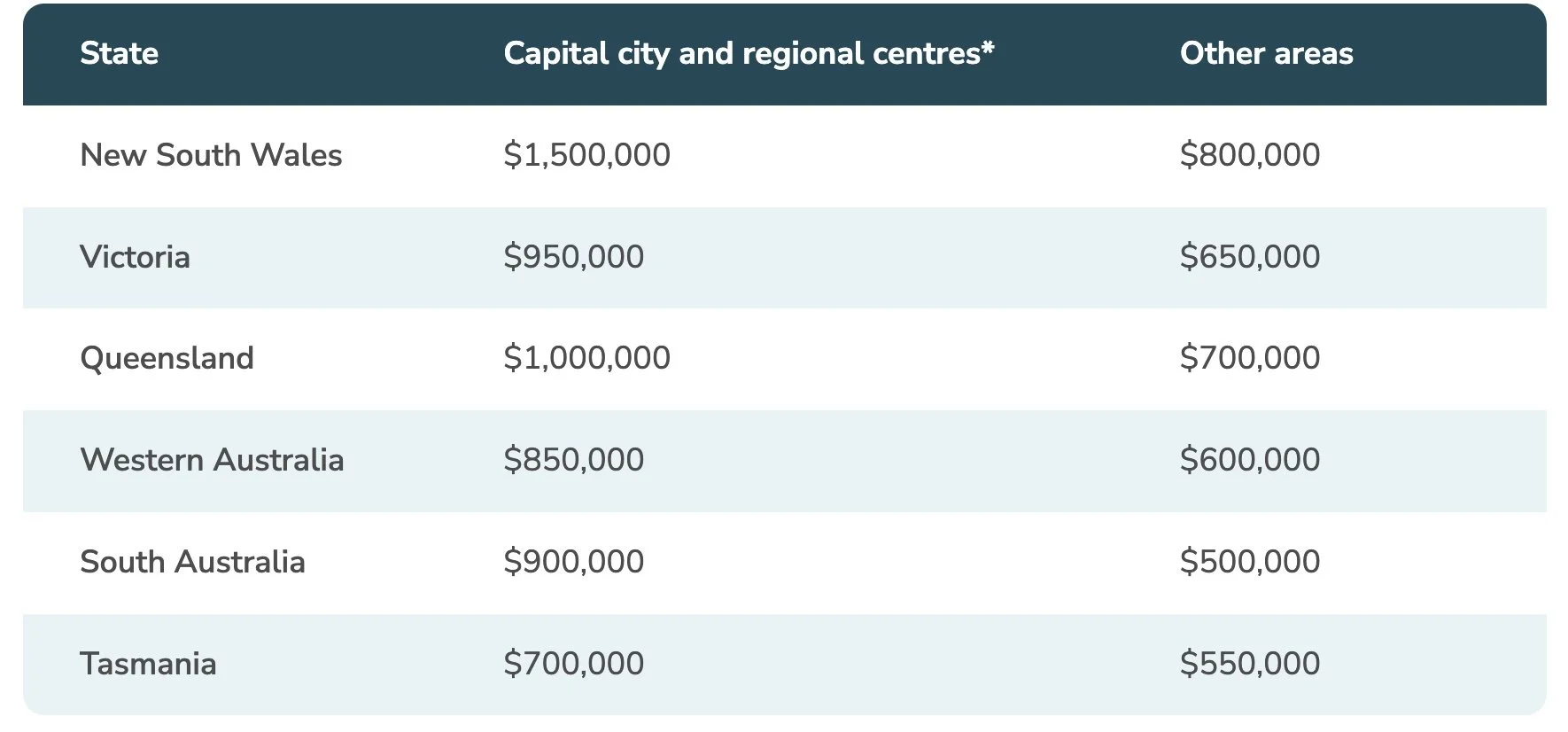

At its core, the scheme allows eligible first home buyers to purchase a property with as little as 5% deposit (or 2% in some single-parent cases), with the Australian Government acting as guarantor for up to 15% of the loan — meaning buyers do not need to pay LMI. Recent reforms have removed income caps and made places unlimited, while increasing property price caps to reflect market values (e.g., Sydney ~$1.5m, Melbourne ~$950k and Brisbane ~$1m).

Market Impacts by City

Sydney: More Buyers, Higher Demand at Entry Level

Sydney has the most expensive property market in Australia, and the Scheme’s expanded price caps have made properties up to around $1.5 million eligible — meaning more aspirational buyers can access government backing.

Impact so far:

A surge in first home buyer activity has been reported since the expansion, with first home buyer applications jumping significantly across major states.

Broader demand at the lower end of the market appears to be putting upward pressure on entry-level prices, particularly where supply is tight. Experts have warned that increased ability to borrow higher amounts can translate into price rises if listings don’t increase concurrently.

In Sydney, where affordability has long been stretched and listings limited, the scheme has accelerated buyers into the market more quickly — a positive for participants but a challenge for overall supply/demand balance.

Melbourne: Uptake Without Immediate Price Shock — Yet

Melbourne’s housing market has been more muted than Sydney’s in recent years. The expanded scheme’s higher price cap (up to ~$950k) has opened up more middle-market properties to first home buyers, driving activity across the metropolitan area.

Key trends:

First home buyer activity has strengthened across Victoria following the policy expansion.

Market commentators note that while Melbourne hasn’t seen dramatic price spikes yet, competition for accessible stock has increased, particularly in desirable inner and middle ring suburbs.

Overall, demand stimulation appears significant in Melbourne, even if median price growth remains tempered compared with Sydney.

Brisbane: Riding the Wave of Increased Participation

Brisbane has been one of the standout beneficiaries in terms of relative uptake of the scheme — both because property prices are more affordable than Sydney and Melbourne, and because the expanded price caps cover much of the local market.

Market effects include:

Strong growth in first home buyer activity, with Queensland among the fastest rising in borrower applications after the expansion.

Heightened competition for affordable stock, contributing to noticeable price growth in segments where first home buyers are active.

Brisbane’s broader market strength over the past few years also means that increased participation from supported buyers translates into real demand, tightening inventory at lower price points.

Common Themes Across the Three Cities

1. Higher Activity, Especially at Entry-Level Price Points

Across Sydney, Melbourne and Brisbane, the extended guarantee has boosted first home buyer participation. Independent data shows a significant rise in weekly applications after the policy was expanded.

2. Risks of Fueling Price Growth in Tight Markets

While helping buyers get into a home sooner, economists and industry voices have warned that supply constraints mean stimulating demand without increasing housing stock can lift prices, especially at the lower end of the market.

In Sydney’s already tight market, this has put particular upward pressure on entry-level homes. In Melbourne and Brisbane, similar dynamics are emerging, albeit with different intensity.

3. Affordability vs. Accessibility Tension

The scheme improves accessibility (lower deposit and avoided LMI) but doesn’t directly improve affordability (actual prices still high relative to income). Some experts have described the policy as a short-term fix that may assist this generation of buyers but not necessarily solve long-term affordability challenges without increased housing supply.

What This Means for Buyers in 2026

If you’re planning to buy in Sydney, Melbourne or Brisbane this year:

Understand how government backing changes your borrowing power.

Realise that demand stimulation can raise prices in targeted segments.

Focus on strong loan structuring and affordability, not just ability to borrow.

Work with a broker early — especially if you’re a first home buyer — to navigate scheme rules and lender criteria.

Conclusion: A Policy With Real Impact — But Mixed Outcomes

The expanded Home Guarantee / 5% Deposit Scheme has had real, measurable effects on participation in major Australian markets. It has helped many first home buyers enter the property market sooner, especially in Brisbane, and contributed to heightened demand in Sydney and Melbourne. However, because supply remains constrained, there are risks of upward price pressure, meaning the scheme isn’t a silver bullet for affordability challenges.

To explore your options, you can book a complimentary discovery call with Principal Mortgage Broker Shona Stephenson.

Shona will walk you through the lending process, assess your borrowing capacity, and help you understand the application pathway and loan structures available to you — recommending the strategy that best fits your situation, goals and risk profile.

You’ll receive clear, practical guidance and the level of care and attention our clients consistently praise.

Best Foot Forward Mortgage Solutions

📞 0417 693 281

✉️ shona@bestff.com.au

🌐 https://www.bestff.com.au/

The information contained is general information only and does not consider your objectives, financial situation and needs. Please talk to us if you need a fast-tracked home loan, and we can help you find a lender that has the processes in place to process the application quickly. We strongly recommend that you do not act on any information provided on this website without individual advice from your trusted advisor. You should also obtain a copy of and consider the Product Disclosure Statement for all financial products before making any decision.

Best Foot Forward always tries to make sure all information is accurate. However, when reading our website, please always consider our Disclaimer policy.