⭐ Another 5-Star Review | HGS Changes Driving the Market | Are You Ready for a Successful Application? | Is It Time to Fix Your Interest Rate?

⭐ Client Spotlight

“Shona made every step easy.” – Joanne, October 2025

🏡 Market Insight

Lenders have tightened their discounting — is now the best time to fix your rate?

Across the major banks, discretionary discounting has reduced in recent months. This means the sharpest variable-rate deals are becoming harder to secure — a trend many industry analysts expect to continue.

With discounts tightening, borrowers are asking:

Will fixed rates become more competitive again?

Should I lock in a portion of my loan?

How will this affect refinancing opportunities?

The cheapest fixed interest rate for Principal and Interest Owner Occupier is 4.89% and 4.99% for an investment property.

🏠 The Impact of the Home Guarantee Scheme on the Property Market

The Home Guarantee Scheme (HGS) has been one of the most consequential housing-market interventions in recent memory — and its effects are rippling across Australia’s property landscape. As your broker and mortgage adviser, I’m watching this closely — because it matters for both homebuyers and investors.

✔️ What is HGS (brief recap)

The HGS helps eligible first-home buyers enter the market with as little as a 5% deposit (or 2% for certain single-parent applicants), instead of the traditional 20%. Under the scheme, the government guarantees a portion of the loan — eliminating the need for expensive Lenders Mortgage Insurance (LMI).

Effective 1 October 2025, the scheme was significantly expanded: annual caps on places removed, income caps abolished and property-price caps raised substantially. That means many more Australians — in more income brackets and across more price points — can now qualify.

📈 What’s happening in the market: increased demand and rising prices

The expanded HGS is already shaping buyer behaviour and market dynamics in a few key ways:

Rising demand from first-home buyers (FHBs): With easier access to low-deposit financing and no LMI, the pool of buyers able to jump into the market has expanded significantly. According to a recent industry-commissioned study, this could translate into an additional 20,600 to 39,100 buyers annually — equivalent to roughly 3.8%–7.1% of all annual home sales.

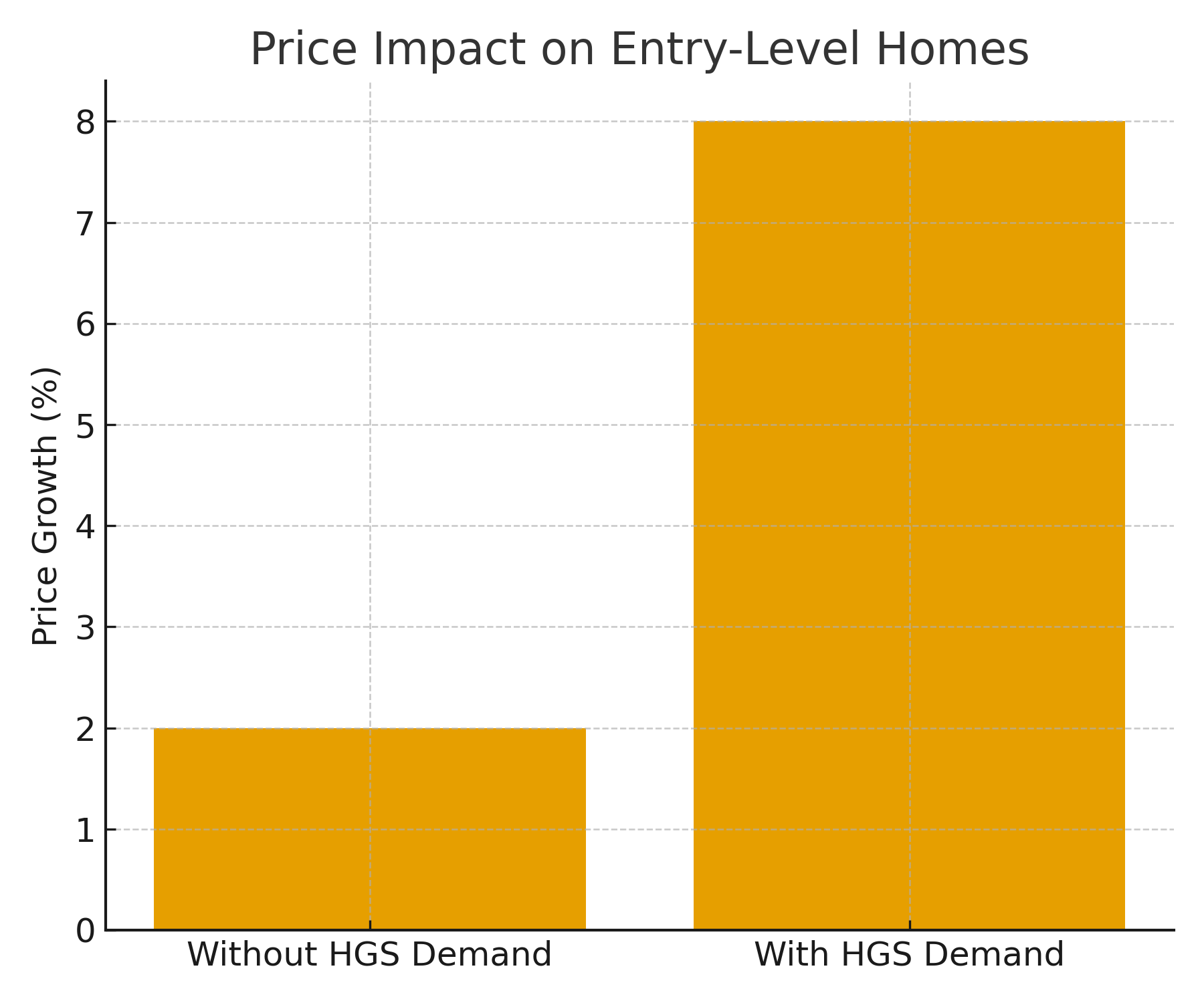

Short-term price uplift — especially in starter home segments: That surge in demand, without a matching increase in supply, tends to push prices up. For the 2026 period and the years immediately following, analysts are projecting a national price increase of 3.5%–6.6%.

Greater impact on entry-level / first-home buyer relevant properties: Homes that fall within the scheme’s price caps — i.e. those that first-home buyers are likely to target — could see even steeper increases: in some cases 5.3%–9.9%.

🎯 What it means for you — as a buyer, investor or broker

As someone who helps (and advises) professionals building wealth through property — the HGS changes things.

For first-home buyers or owner-occupiers: HGS offers a rare opportunity to get into the market sooner, and avoid years of saving for a big deposit or the significant cost of LMI. But it’s worth being strategic: know what price band you’re targeting, what your long-term servicing capacity is, and avoid overpaying just because demand is hot.

For investors or existing homeowners: The expanded scheme may increase competition — especially in entry-level or starter-home segments. Expect tighter supply, higher purchase prices, and possibly upward pressure on rents if demand outpaces supply.

For property strategists and brokers like Best Foot Forward. Mortgage Solutions: HGS underscores the importance of tailored advice. With mortgage accessibility shifting, the right strategy (deposit amount, loan structure, fixed vs variable rate, long-term plan) becomes even more critical.

⭐ We Are Home Guarantee Scheme (HGS) Specialists

At Best Foot Forward Mortgage Solutions, we specialise in guiding clients through the Home Guarantee Scheme (HGS) with precision and care. Our team has achieved a 100% approval success rate for HGS applications this year — a testament to our deep expertise and our commitment to getting every detail right.

HGS loans require careful structuring, clear documentation and experienced guidance. That’s where we excel. From your first conversation through to settlement, we provide:

Personalised support tailored to your financial goals

Clear, proactive communication at every stage

Expert guidance in an increasingly complex lending environment

Our results speak for themselves — but it’s our client-first approach that truly sets us apart.

If you're considering entering the market using the Home Guarantee Scheme, we’re here to put your best foot forward.

To explore your options, you can book a complimentary discovery call with Shona Stephenson, our dedicated HGS specialist. Shona will walk you through your eligibility, the application process, and the best lending strategy for your situation — with the clarity and care our clients consistently praise.

The information contained is general information only and does not consider your objectives, financial situation and needs. Please talk to us if you need a fast-tracked home loan, and we can help you find a lender that has the processes in place to process the application quickly. We strongly recommend that you do not act on any information provided on this website without individual advice from your trusted advisor. You should also obtain a copy of and consider the Product Disclosure Statement for all financial products before making any decision.

Best Foot Forward always tries to make sure all information is accurate. However, when reading our website, please always consider our Disclaimer policy.