Changes to the Housing Australia Guarantee Scheme, Self Employed Approval in MINUTES, plus have you heard of a Builders Agent? Property Webinar this Thursday.

First Home Buyers – You’re in the Thick of It!

If you’re a first home buyer right now, you know the market is intense. 21 applications for a single property is not unusual, and if you don’t have serious backing from your mortgage broker, it can feel like you’ve been fed to the wolves!

Just this past week, I’ve helped clients navigate:

✔ Poor building and pest inspections

✔ Lawyers missing critical details

✔ Agents being less than transparent about real body corporate costs

We even help our clients make informed offers by sharing key stats with them about the “Low, Estimate and High” price for their property.

SUCCESS! Their offer was accepted!

For another couple,

We secured a “tricky” self-employed pre-approval and refinance—and it was approved within minutes of submission! (Of course, we didn’t tell the clients immediately, because it felt too good to be true!) They were on holidays and we waited until they were in reception before we could tell them the good news!

🚨 Newsflash: MASSIVE Property Market Changes!

Attention all buyers! Big changes are coming that could impact properties up to $1.5 million.

Housing Australia Guarantee Scheme (HGS) Updates – Effective 1 October 2025:

If you’re a first home buyer, big changes are coming that could make entering the market much easier! From 1 October 2025, the Australian Government is expanding the Home Guarantee Scheme (HGS) with unlimited places and increased property price caps—making it easier than ever to buy your first home with as little as a 5% deposit and no Lenders Mortgage Insurance.

What’s Changing from 1 October 2025?

✅ Unlimited places – No more quotas! All Australian first home buyers who have saved a 5% deposit can apply.

✅ No income caps – Higher-income buyers can now access the Scheme.

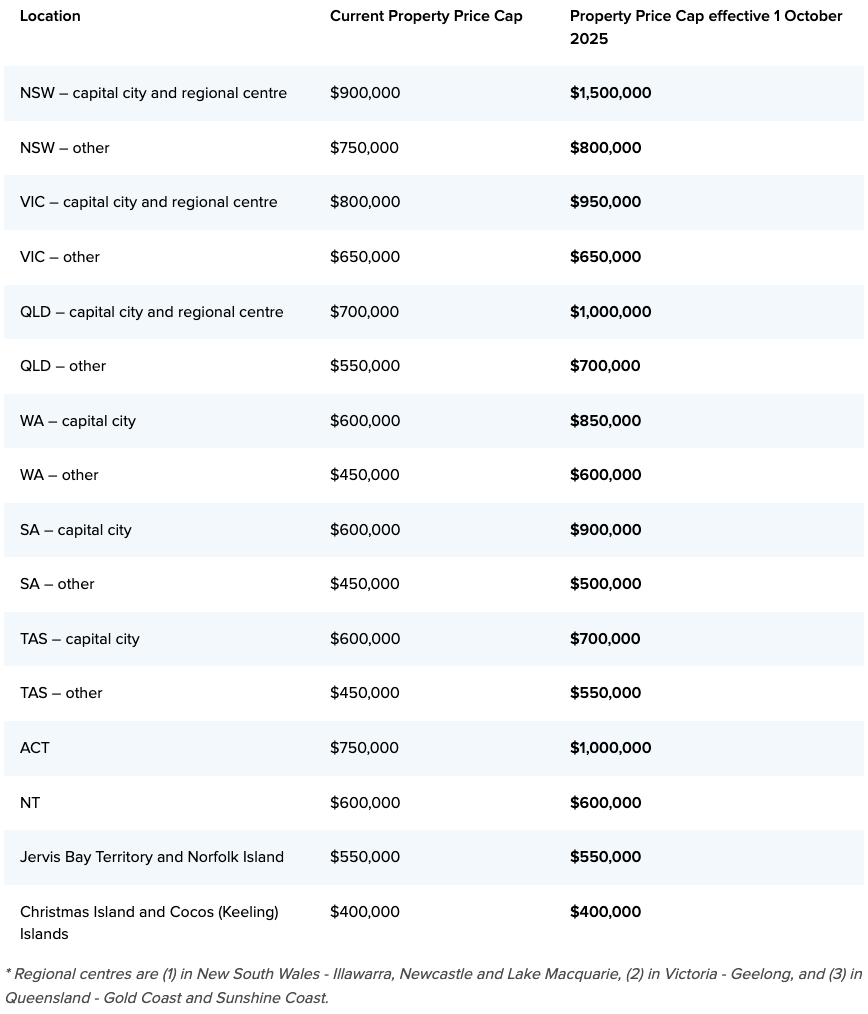

✅ Higher property price caps – To reflect rising property values (see full table below).

✅ Simpler access for regional buyers – The Regional First Home Buyer Guarantee will be replaced by the First Home Guarantee.

The Home Guarantee Scheme is available through over 30 participating lenders, including major banks and customer-owned banks.

New Property Price Caps from 1 October 2025

What Does This Mean for You?

These changes are huge. If you’ve been priced out of the market or ineligible due to income limits, October 2025 is your chance. Even better—unlimited places mean you won’t miss out because of allocation limits.

But here’s the thing: you don’t have to wait until October to get started. The Scheme is available now under current eligibility criteria, and we can help you plan ahead so you’re ready when these changes kick in.

Ready to Take Your First Step? Let’s Chat About Your Next Move

Not sure if you qualify now, or if it’s better to wait until 1 October? Let’s find out together.

If you’re thinking about purchasing property tomorrow or in the next 6 months, we highly recommend booking a complimentary one-on-one discovery call with us. This session will:

✔ Clarify your options under the current Home Guarantee Scheme

✔ Explore what the October changes could mean for you

✔ Give you a clear strategy for moving forward confidently

The Window is Now: Why 2025 Could Be the Smartest Time to Invest in Property

📅 Date: Thursday 28 August 2025 | 🕕 Time: 6:00 PM (60 mins)

💰 Cost: Free | 🎤 Speakers: Emma Allen & Chris Newell

The Australian property market is shifting—fast. With interest rate cuts anticipated and buyer demand set to rise, 2025 could be a pivotal year for property investors.

In this free 60-minute webinar, you’ll learn:

✔ Why the current market window matters—and how to leverage it

✔ Where the best opportunities lie in 2025

✔ How to invest consciously and strategically, even if you’re time-poor

No hype—just expert insights from API Founder Emma Allen and Sales Manager Chris Newell, both passionate about helping Australians build long-term wealth through property.

✅ Reserve your spot today and take control of your financial future.

See you on Thursday!

The information contained is general information only and does not consider your objectives, financial situation and needs. Please talk to us if you need a fast-tracked home loan, and we can help you find a lender that has the processes in place to process the application quickly. We strongly recommend that you do not act on any information provided on this website without individual advice from your trusted advisor. You should also obtain a copy of and consider the Product Disclosure Statement for all financial products before making any decision.

Best Foot Forward always tries to make sure all information is accurate. However, when reading our website, please always consider our Disclaimer policy.