Interest Rates on Hold at 3.6%. Changes to the Housing Australia Guarantee, Cotality Property Market Update.

🏡 Best Foot Forward Mortgage Solutions – October Newsletter

Reserve Bank Holds Cash Rate Steady at 3.6%

The Reserve Bank of Australia has chosen to hold the cash rate at 3.6%, offering stability for borrowers after a period of sharp rate rises. This pause provides homeowners and investors with breathing space while the RBA monitors inflation, wages, and spending.

For mortgage holders, repayments remain steady for now — but the RBA has signalled it is prepared to adjust if inflation does not continue to ease. Now is an excellent time to review your loan structure, lock in competitive rates, and plan ahead for potential changes. If you are paying more than 5.5% you are probably paying too much.

The cheapest fixed rate I've seen is 4.79% with Suncorp for a 2-year term. If you are considering refinancing, now is an excellent time to lock in a competitive interest rate, as we anticipate one more rate increase in this interest rate cycle.

Housing Australia Scheme Changes – More Opportunities From October 2025

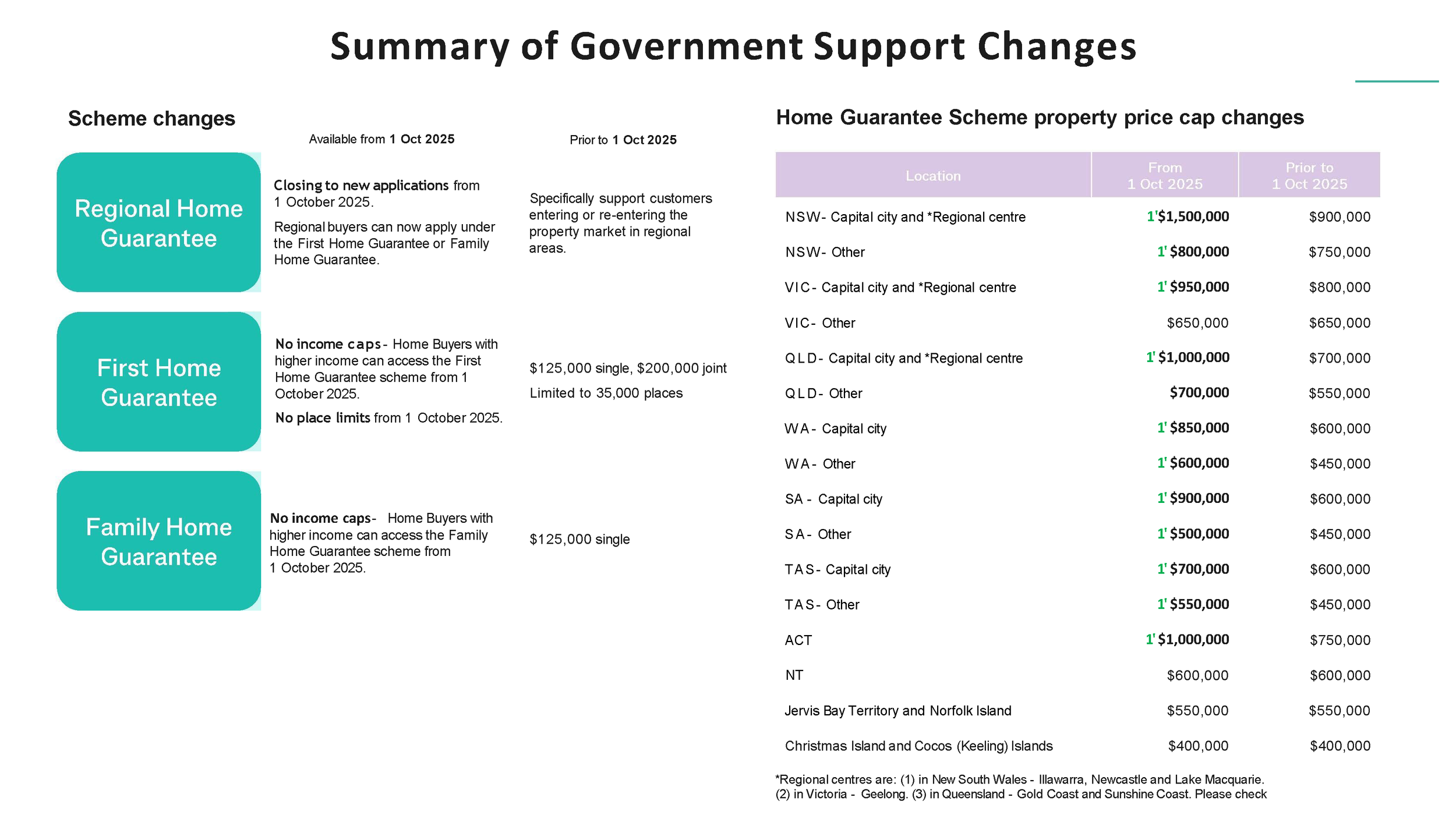

Big changes are coming to the Housing Australia Home Guarantee Schemes (First Home Guarantee, Family Home Guarantee, and Regional Home Guarantee), effective 1 October 2025.

No more income caps – Higher income buyers now qualify.

No more place limits – Schemes won’t run out of spaces.

Increased property price caps across the country:

Sydney / Newcastle / Wollongong: up to $1.5M (from $900k)

Melbourne / Geelong: up to $950k (from $800k)

Brisbane / Sunshine Coast / Gold Coast: up to $1M (from $700k)

Other states and regions also see major boosts.

💡 With just a 5% deposit (or 2% for single parents under the Family Guarantee), eligible buyers can purchase without paying Lenders Mortgage Insurance (LMI).

👉 If you’ve been waiting for the right time, these changes mean you may now qualify for more support than ever before.

Cotality Property Market Update – October 2025

The latest Cotality Home Value Index shows that the Australian housing market is gaining strength heading into spring.

📊 Key Highlights (to end of September 2025):

National dwelling values rose 0.8% in September and are up 4.8% annually, with the median home value now $857,280.

Capital city markets led the way (+0.9% in September), while regional markets rose more moderately (+0.7%).

Brisbane (+3.5% quarterly) and Perth (+4.0% quarterly) are standout performers, with Darwin surging ahead (+5.9% quarterly).

Sydney values climbed 2.1% over the quarter, taking the median dwelling to $1.24M.

Listings remain low – with advertised stock up to 45% below average in Perth and 31% below average in Brisbane, pushing prices higher due to supply constraints.

Rental markets remain tight, with the national vacancy rate at a record low of 1.4%, further fuelling competition.

Outlook:

Vendors have the advantage this spring, with limited stock and strong buyer demand.

Expanded government support schemes will likely add further competition in suburbs newly included under higher price caps.

Buyers may want to act quickly before values climb beyond new scheme thresholds.

✅ What This Means for You

First-home buyers and families – The expanded Housing Australia schemes make it easier to enter the market with smaller deposits.

Homeowners – With rates steady, now’s the time to explore refinancing or fixing part of your loan.

Investors – With rental vacancy at historic lows, yields remain attractive in key growth areas.

At Best Foot Forward Mortgage Solutions, we’re here to help you take advantage of market opportunities and government support.

📞 Get in touch today 0417 693 281 to review your options and put your best foot forward towards your property goals.

The information contained is general information only and does not consider your objectives, financial situation and needs. Please talk to us if you need a fast-tracked home loan, and we can help you find a lender that has the processes in place to process the application quickly. We strongly recommend that you do not act on any information provided on this website without individual advice from your trusted advisor. You should also obtain a copy of and consider the Product Disclosure Statement for all financial products before making any decision.

Best Foot Forward always tries to make sure all information is accurate. However, when reading our website, please always consider our Disclaimer policy.